Page 62 - 5.2 i. Manac Finance ITC Summarised Notes

P. 62

COST OF CAPITAL

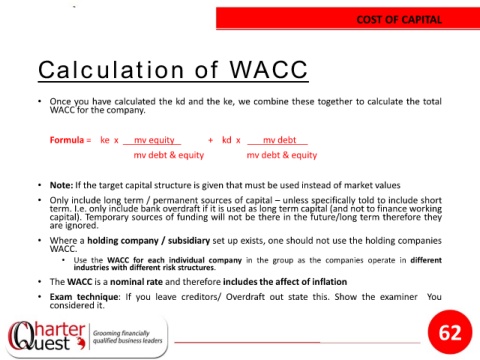

Calculation of WACC

• Once you have calculated the kd and the ke, we combine these together to calculate the total

WACC for the company.

Formula = ke x mv equity + kd x mv debt .

mv debt & equity mv debt & equity

• Note: If the target capital structure is given that must be used instead of market values

• Only include long term / permanent sources of capital – unless specifically told to include short

term. I.e. only include bank overdraft if it is used as long term capital (and not to finance working

capital). Temporary sources of funding will not be there in the future/long term therefore they

are ignored.

• Where a holding company / subsidiary set up exists, one should not use the holding companies

WACC.

• Use the WACC for each individual company in the group as the companies operate in different

industries with different risk structures.

• The WACC is a nominal rate and therefore includes the affect of inflation

• Exam technique: If you leave creditors/ Overdraft out state this. Show the examiner You

considered it.

62