Page 63 - 5.2 i. Manac Finance ITC Summarised Notes

P. 63

COST OF CAPITAL

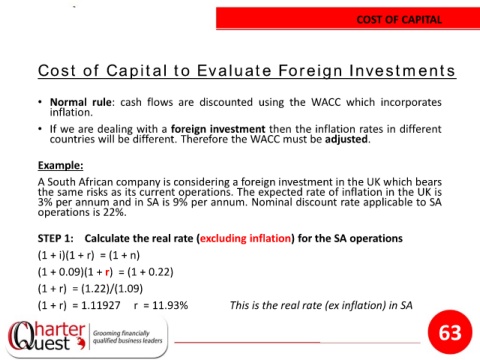

Cost of Capital to Evaluate Foreign Investments

• Normal rule: cash flows are discounted using the WACC which incorporates

inflation.

• If we are dealing with a foreign investment then the inflation rates in different

countries will be different. Therefore the WACC must be adjusted.

Example:

A South African company is considering a foreign investment in the UK which bears

the same risks as its current operations. The expected rate of inflation in the UK is

3% per annum and in SA is 9% per annum. Nominal discount rate applicable to SA

operations is 22%.

STEP 1: Calculate the real rate (excluding inflation) for the SA operations

(1 + i)(1 + r) = (1 + n)

(1 + 0.09)(1 + r) = (1 + 0.22)

(1 + r) = (1.22)/(1.09)

(1 + r) = 1.11927 r = 11.93% This is the real rate (ex inflation) in SA

63