Page 192 - FR Integrated Workbook 2018-19

P. 192

Chapter 14

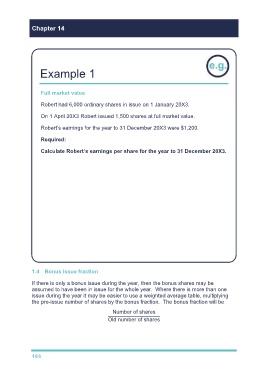

Example 1

Full market value

Robert had 6,000 ordinary shares in issue on 1 January 20X3.

On 1 April 20X3 Robert issued 1,500 shares at full market value.

Robert’s earnings for the year to 31 December 20X3 were $1,200.

Required:

Calculate Robert’s earnings per share for the year to 31 December 20X3.

Solution

No of shares Fraction of Weighted

year held average

b/f 6,000 × 3 / 12 1,500

Issue 1,500

—–—

Total 7,500 × 9 / 12 5,625

—–— —–—

7,125

———

Earnings per share = 1,200 ÷ 7,125 = 16.8¢

1.4 Bonus issue fraction

If there is only a bonus issue during the year, then the bonus shares may be

assumed to have been in issue for the whole year. Where there is more than one

issue during the year it may be easier to use a weighted average table, multiplying

the pre-issue number of shares by the bonus fraction. The bonus fraction will be

Number of shares

Old number of shares

186