Page 193 - FR Integrated Workbook 2018-19

P. 193

Earnings per share

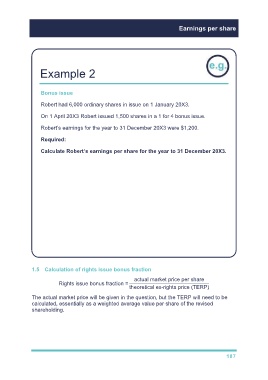

Example 2

Bonus issue

Robert had 6,000 ordinary shares in issue on 1 January 20X3.

On 1 April 20X3 Robert issued 1,500 shares in a 1 for 4 bonus issue.

Robert’s earnings for the year to 31 December 20X3 were $1,200.

Required:

Calculate Robert’s earnings per share for the year to 31 December 20X3.

Solution

Bonus shares are deemed to have been in issue for full year.

No of shares Fraction of Weighted

year held average

b/f 6,000

Bonus issue 1:4 1,500

—––—

Total 7,500 × 12 / 12 7,500

——— ———

Earnings per share = 1,200 ÷ 7,500 = 16.0¢

1.5 Calculation of rights issue bonus fraction

actual market price per share

Rights issue bonus fraction =

theoretical ex-rights price (TERP)

The actual market price will be given in the question, but the TERP will need to be

calculated, essentially as a weighted average value per share of the revised

shareholding.

187