Page 257 - FR Integrated Workbook 2018-19

P. 257

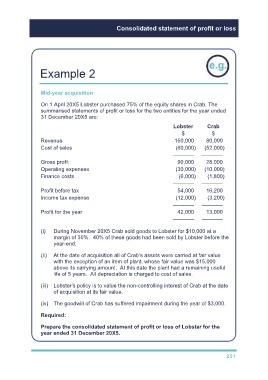

Consolidated statement of profit or loss

Example 2

Mid-year acquisition

On 1 April 20X5 Lobster purchased 75% of the equity shares in Crab. The

summarised statements of profit or loss for the two entities for the year ended

31 December 20X5 are:

Lobster Crab

$ $

Revenue 150,000 80,000

Cost of sales (60,000) (52,000)

––––––– –––––––

Gross profit 90,000 28,000

Operating expenses (30,000) (10,000)

Finance costs (6,000) (1,800)

––––––– –––––––

Profit before tax 54,000 16,200

Income tax expense (12,000) (3,200)

––––––– –––––––

Profit for the year 42,000 13,000

––––––– –––––––

(i) During November 20X5 Crab sold goods to Lobster for $10,000 at a

margin of 30%. 40% of these goods had been sold by Lobster before the

year-end.

(ii) At the date of acquisition all of Crab’s assets were carried at fair value

with the exception of an item of plant, whose fair value was $15,000

above its carrying amount. At this date the plant had a remaining useful

life of 5 years. All depreciation is charged to cost of sales.

(iii) Lobster’s policy is to value the non-controlling interest of Crab at the date

of acquisition at its fair value.

(iv) The goodwill of Crab has suffered impairment during the year of $3,000.

Required:

Prepare the consolidated statement of profit or loss of Lobster for the

year ended 31 December 20X5.

251