Page 252 - FR Integrated Workbook 2018-19

P. 252

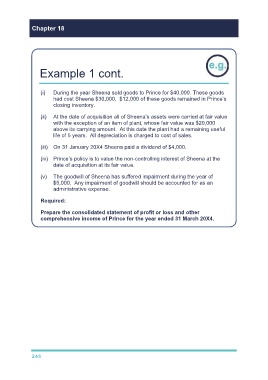

Chapter 18

Example 1 cont.

(i) During the year Sheena sold goods to Prince for $40,000. These goods

had cost Sheena $30,000. $12,000 of these goods remained in Prince’s

closing inventory.

(ii) At the date of acquisition all of Sheena’s assets were carried at fair value

with the exception of an item of plant, whose fair value was $20,000

above its carrying amount. At this date the plant had a remaining useful

life of 5 years. All depreciation is charged to cost of sales.

(iii) On 31 January 20X4 Sheena paid a dividend of $4,000.

(iv) Prince’s policy is to value the non-controlling interest of Sheena at the

date of acquisition at its fair value.

(v) The goodwill of Sheena has suffered impairment during the year of

$5,000. Any impairment of goodwill should be accounted for as an

administrative expense.

Required:

Prepare the consolidated statement of profit or loss and other

comprehensive income of Prince for the year ended 31 March 20X4.

246