Page 346 - FR Integrated Workbook 2018-19

P. 346

Chapter 24

Chapter 5

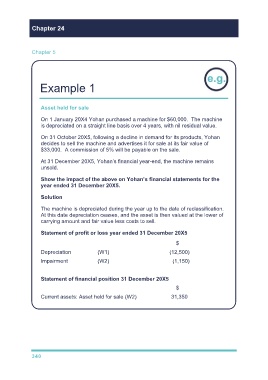

Example 1

Asset held for sale

On 1 January 20X4 Yohan purchased a machine for $60,000. The machine

is depreciated on a straight line basis over 4 years, with nil residual value.

On 31 October 20X5, following a decline in demand for its products, Yohan

decides to sell the machine and advertises it for sale at its fair value of

$33,000. A commission of 5% will be payable on the sale.

At 31 December 20X5, Yohan’s financial year-end, the machine remains

unsold.

Show the impact of the above on Yohan’s financial statements for the

year ended 31 December 20X5.

Solution

The machine is depreciated during the year up to the date of reclassification.

At this date depreciation ceases, and the asset is then valued at the lower of

carrying amount and fair value less costs to sell.

Statement of profit or loss year ended 31 December 20X5

$

Depreciation (W1) (12,500)

Impairment (W2) (1,150)

Statement of financial position 31 December 20X5

$

Current assets: Asset held for sale (W2) 31,350

340