Page 347 - FR Integrated Workbook 2018-19

P. 347

Answers

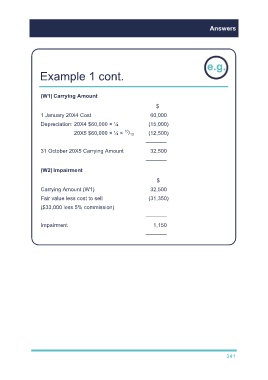

Example 1 cont.

(W1) Carrying Amount

$

1 January 20X4 Cost 60,000

Depreciation: 20X4 $60,000 × ¼ (15,000)

10

20X5 $60,000 × ¼ × / 12 (12,500)

–––––––

31 October 20X5 Carrying Amount 32,500

–––––––

(W2) Impairment

$

Carrying Amount (W1) 32,500

Fair value less cost to sell (31,350)

($33,000 less 5% commission)

–––––––

Impairment 1,150

–––––––

341