Page 352 - FR Integrated Workbook 2018-19

P. 352

Chapter 24

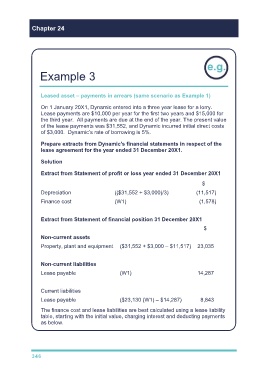

Example 3

Leased asset – payments in arrears (same scenario as Example 1)

On 1 January 20X1, Dynamic entered into a three year lease for a lorry.

Lease payments are $10,000 per year for the first two years and $15,000 for

the third year. All payments are due at the end of the year. The present value

of the lease payments was $31,552, and Dynamic incurred initial direct costs

of $3,000. Dynamic’s rate of borrowing is 5%.

Prepare extracts from Dynamic's financial statements in respect of the

lease agreement for the year ended 31 December 20X1.

Solution

Extract from Statement of profit or loss year ended 31 December 20X1

$

Depreciation (($31,552 + $3,000)/3) (11,517)

Finance cost (W1) (1,578)

Extract from Statement of financial position 31 December 20X1

$

Non-current assets

Property, plant and equipment ($31,552 + $3,000 – $11,517) 23,035

Non-current liabilities

Lease payable (W1) 14,287

Current liabilities

Lease payable ($23,130 (W1) – $14,287) 8,843

The finance cost and lease liabilities are best calculated using a lease liability

table, starting with the initial value, charging interest and deducting payments

as below.

346