Page 111 - ADVANCED TAXATION - Day 1 Slides

P. 111

111

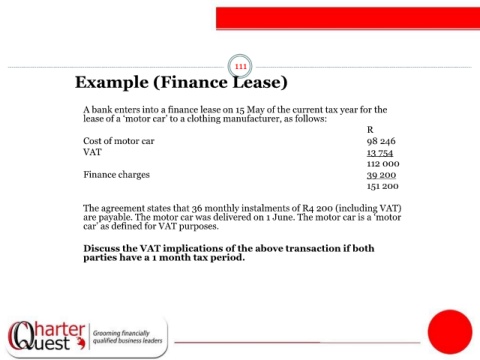

Example (Finance Lease)

A bank enters into a finance lease on 15 May of the current tax year for the

lease of a ‘motor car’ to a clothing manufacturer, as follows:

R

Cost of motor car 98 246

VAT 13 754

112 000

Finance charges 39 200

151 200

The agreement states that 36 monthly instalments of R4 200 (including VAT)

are payable. The motor car was delivered on 1 June. The motor car is a ‘motor

car’ as defined for VAT purposes.

Discuss the VAT implications of the above transaction if both

parties have a 1 month tax period.