Page 106 - ADVANCED TAXATION - Day 1 Slides

P. 106

106

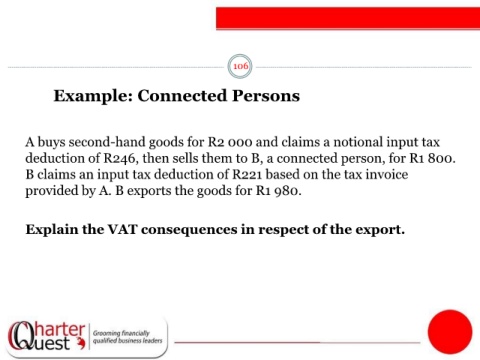

Example: Connected Persons

A buys second-hand goods for R2 000 and claims a notional input tax

deduction of R246, then sells them to B, a connected person, for R1 800.

B claims an input tax deduction of R221 based on the tax invoice

provided by A. B exports the goods for R1 980.

Explain the VAT consequences in respect of the export.