Page 102 - ADVANCED TAXATION - Day 1 Slides

P. 102

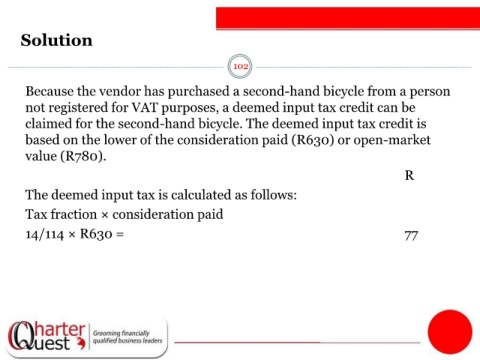

Solution

102

Because the vendor has purchased a second-hand bicycle from a person

not registered for VAT purposes, a deemed input tax credit can be

claimed for the second-hand bicycle. The deemed input tax credit is

based on the lower of the consideration paid (R630) or open-market

value (R780).

R

The deemed input tax is calculated as follows:

Tax fraction × consideration paid

14/114 × R630 = 77