Page 100 - ADVANCED TAXATION - Day 1 Slides

P. 100

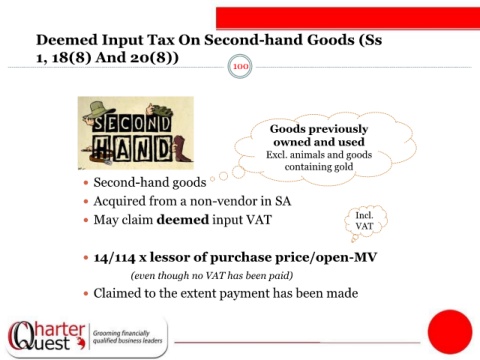

Deemed Input Tax On Second-hand Goods (Ss

1, 18(8) And 20(8))

100

Goods previously

owned and used

Excl. animals and goods

containing gold

Second-hand goods

Acquired from a non-vendor in SA

May claim deemed input VAT Incl.

VAT

14/114 x lessor of purchase price/open-MV

(even though no VAT has been paid)

Claimed to the extent payment has been made