Page 95 - ADVANCED TAXATION - Day 1 Slides

P. 95

95

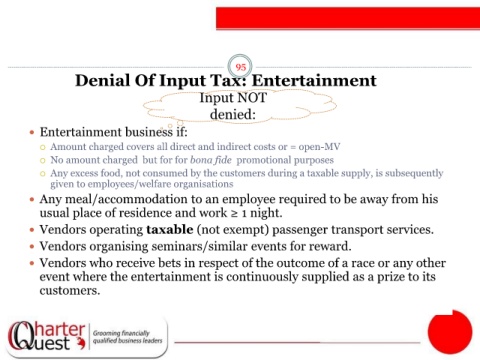

Denial Of Input Tax: Entertainment

Input NOT

denied:

Entertainment business if:

Amount charged covers all direct and indirect costs or = open-MV

No amount charged but for for bona fide promotional purposes

Any excess food, not consumed by the customers during a taxable supply, is subsequently

given to employees/welfare organisations

Any meal/accommodation to an employee required to be away from his

usual place of residence and work ≥ 1 night.

Vendors operating taxable (not exempt) passenger transport services.

Vendors organising seminars/similar events for reward.

Vendors who receive bets in respect of the outcome of a race or any other

event where the entertainment is continuously supplied as a prize to its

customers.