Page 73 - ADVANCED TAXATION - Day 1 Slides

P. 73

73

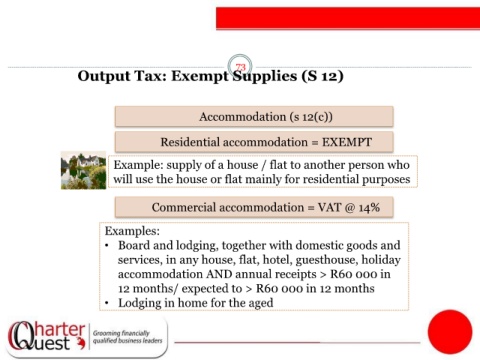

Output Tax: Exempt Supplies (S 12)

l

Accommodation (s 12(c))

Residential accommodation = EXEMPT

Example: supply of a house / flat to another person who

will use the house or flat mainly for residential purposes

Commercial accommodation = VAT @ 14%

Examples:

• Board and lodging, together with domestic goods and

services, in any house, flat, hotel, guesthouse, holiday

accommodation AND annual receipts > R60 000 in

12 months/ expected to > R60 000 in 12 months

• Lodging in home for the aged