Page 77 - ADVANCED TAXATION - Day 1 Slides

P. 77

77

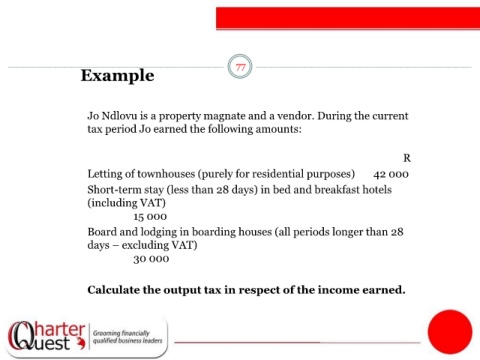

Example

Jo Ndlovu is a property magnate and a vendor. During the current

tax period Jo earned the following amounts:

R

Letting of townhouses (purely for residential purposes) 42 000

Short-term stay (less than 28 days) in bed and breakfast hotels

(including VAT)

15 000

Board and lodging in boarding houses (all periods longer than 28

days – excluding VAT)

30 000

Calculate the output tax in respect of the income earned.