Page 13 - F6 Slide - VAT Part 4 - Lecture Day 5

P. 13

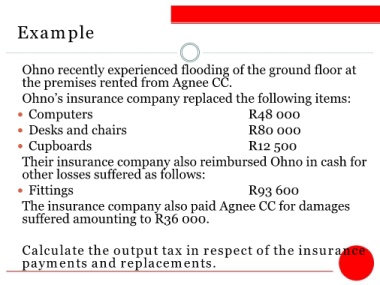

Example

Ohno recently experienced flooding of the ground floor at

the premises rented from Agnee CC.

Ohno’s insurance company replaced the following items:

Computers R48 000

Desks and chairs R80 000

Cupboards R12 500

Their insurance company also reimbursed Ohno in cash for

other losses suffered as follows:

Fittings R93 600

The insurance company also paid Agnee CC for damages

suffered amounting to R36 000.

Calculate the output tax in respect of the insurance

payments and replacements.