Page 9 - F6 Slide - VAT Part 4 - Lecture Day 5

P. 9

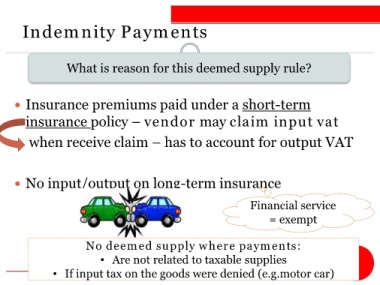

Indemnity Payments

What is reason for this deemed supply rule?

Insurance premiums paid under a short-term

insurance policy – vendor may claim input vat

when receive claim – has to account for output VAT

No input/output on long-term insurance

Financial service

= exempt

No deemed supply where payments:

• Are not related to taxable supplies

• If input tax on the goods were denied (e.g.motor car)