Page 7 - F6 Slide - VAT Part 4 - Lecture Day 5

P. 7

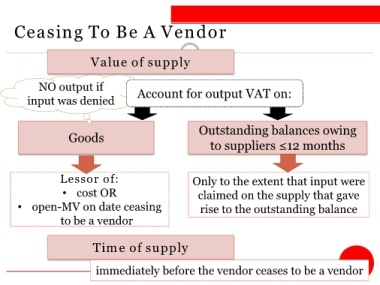

Ceasing To Be A Vendor

Value of supply

NO output if

input was denied Account for output VAT on:

Outstanding balances owing

Goods

to suppliers ≤12 months

Lessor of: Only to the extent that input were

• cost OR claimed on the supply that gave

• open-MV on date ceasing rise to the outstanding balance

to be a vendor

Time of supply

immediately before the vendor ceases to be a vendor