Page 105 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 105

Asset investment decisions and capital rationing

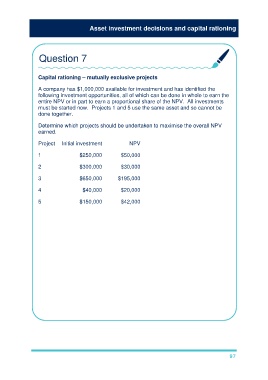

Question 7

Capital rationing – mutually exclusive projects

A company has $1,000,000 available for investment and has identified the

following investment opportunities, all of which can be done in whole to earn the

entire NPV or in part to earn a proportional share of the NPV. All investments

must be started now. Projects 1 and 5 use the same asset and so cannot be

done together.

Determine which projects should be undertaken to maximise the overall NPV

earned.

Project Initial investment NPV

1 $250,000 $50,000

2 $300,000 $30,000

3 $650,000 $195,000

4 $40,000 $20,000

5 $150,000 $42,000

Choosing project 1 over project 5

Project Initial investment NPV PI Rank Invest NPV

1 $250,000 $50,000 0.2 4 $250k $50k

2 $300,000 $30,000 0.1 5 $60k $6k

3 $650,000 $195,000 0.3 2 $650k $195k

4 $40,000 $20,000 0.5 1 $40k $20k

5 $150,000 $42,000 0.28 3

$1,000k $271k

Only ($60k/$300k) 20% of project 2 can be done, earning 20% of its total NPV.

97