Page 102 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 102

Chapter 5

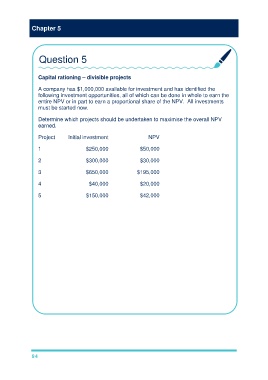

Question 5

Capital rationing – divisible projects

A company has $1,000,000 available for investment and has identified the

following investment opportunities, all of which can be done in whole to earn the

entire NPV or in part to earn a proportional share of the NPV. All investments

must be started now.

Determine which projects should be undertaken to maximise the overall NPV

earned.

Project Initial investment NPV

1 $250,000 $50,000

2 $300,000 $30,000

3 $650,000 $195,000

4 $40,000 $20,000

5 $150,000 $42,000

Project Initial investment NPV PI Rank Invest NPV

1 $250,000 $50,000 0.2 4 $160k $32k

2 $300,000 $30,000 0.1 5

3 $650,000 $195,000 0.3 2 $650k $195k

4 $40,000 $20,000 0.5 1 $40k $20k

5 $150,000 $42,000 0.28 3 $150k $42k

$1,000k $289k

Only ($160k/$250k) 64% of project 1 can be done, earning 64% of its total NPV.

94