Page 97 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 97

Asset investment decisions and capital rationing

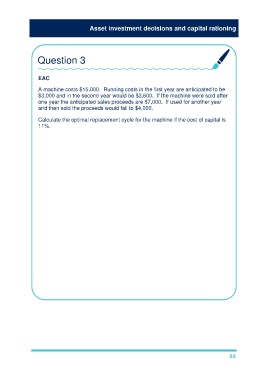

Question 3

EAC

A machine costs $15,000. Running costs in the first year are anticipated to be

$3,000 and in the second year would be $3,600. If the machine were sold after

one year the anticipated sales proceeds are $7,000. If used for another year

and then sold the proceeds would fall to $4,000.

Calculate the optimal replacement cycle for the machine if the cost of capital is

11%.

1 year cycle

t0 (15,000) × 1 = (15,000)

t1 [(3,000) + 7,000] × 0.901 = 3,604

Total PV of cycle = $(11,396)

EAC = (11,396)/0.901 = $(12,648)

2 year cycle

t0 (15,000) × 1 = (15,000)

t1 (3,000) × 0.901 = (2,703)

t2 [(3,600) + 4,000] × 0.812 = 325

Total PV of cycle = $(17,378)

EAC = (17,378)/1.713 = $(10,145)

The 2 year cycle is the cheaper option.

89