Page 95 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 95

Asset investment decisions and capital rationing

Replacement decisions

If a capital asset is to be replaced, there are different potential replacement

strategies.

Issues arise where there are competing replacements for a particular asset:

Equivalent available assets may last for different lengths of time

Assets may need to be replaced at regular intervals

Calculation of the present costs of each available asset will make each individual set

of cash flows equivalent to each other in terms of time value but will not make the

overall decisions comparable to each other.

For instance an asset that lasts for two years may be cheaper than an asset that

lasts for four but the replacement cash flows would have to be spent twice as

frequently.

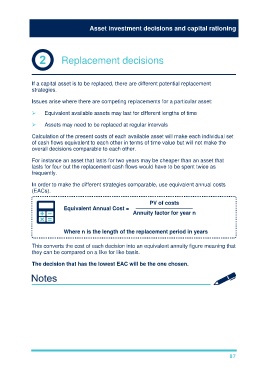

In order to make the different strategies comparable, use equivalent annual costs

(EACs).

PV of costs

Equivalent Annual Cost = –––––––––––––––––––

Annuity factor for year n

Where n is the length of the replacement period in years

This converts the cost of each decision into an equivalent annuity figure meaning that

they can be compared on a like for like basis.

The decision that has the lowest EAC will be the one chosen.

87