Page 115 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 115

Investment appraisal under uncertainty

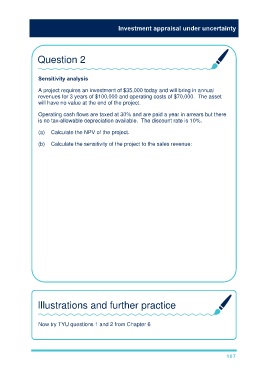

Question 2

Sensitivity analysis

A project requires an investment of $35,000 today and will bring in annual

revenues for 3 years of $100,000 and operating costs of $70,000. The asset

will have no value at the end of the project.

Operating cash flows are taxed at 30% and are paid a year in arrears but there

is no tax-allowable depreciation available. The discount rate is 10%.

(a) Calculate the NPV of the project.

(b) Calculate the sensitivity of the project to the sales revenue:

(a)

df/af 10% PV

t0 purchase (35,000) 1 (35,000)

t1-3 revenue 100,000 2.487 248,700

t1-3 operating costs (70,000) 2.487 (174,090)

t2-4 taxation (9,000) 2.487 × 0.909 (20,346)

NPV 19,264

(b) If revenue changes, so will tax – by 30% of the revenue value and with a

1 year time delay.

PV of revenue = $248,700

PV of taxation = $248,700 × 30% × 0.909 = $67,820

Net PV affected = $248,700 – $67,820 = $180,880

Sensitivity = $19,264/$180,880 × 100 = 10.7%

Illustrations and further practice

Now try TYU questions 1 and 2 from Chapter 6

107