Page 21 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 21

Basic investment appraisal techniques

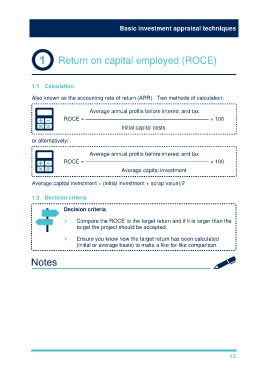

Return on capital employed (ROCE)

1.1 Calculation

Also known as the accounting rate of return (ARR). Two methods of calculation:

Average annual profits before interest and tax

ROCE = ––––––––––––––––––––––––––––––––––––––––– × 100

Initial capital costs

or alternatively:

Average annual profits before interest and tax

ROCE = ––––––––––––––––––––––––––––––––––––––––– × 100

Average capital investment

Average capital investment = (initial investment + scrap value)/2

1.2 Decision criteria

Decision criteria

Compare the ROCE to the target return and if it is larger than the

target the project should be accepted.

Ensure you know how the target return has been calculated

(initial or average basis) to make a like-for-like comparison.

13