Page 23 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 23

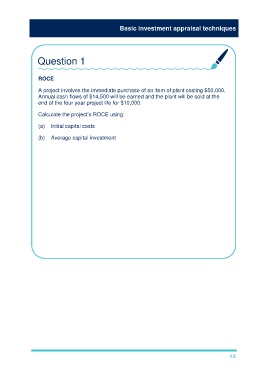

Basic investment appraisal techniques

Question 1

ROCE

A project involves the immediate purchase of an item of plant costing $50,000.

Annual cash flows of $14,500 will be earned and the plant will be sold at the

end of the four year project life for $10,000.

Calculate the project’s ROCE using:

(a) Initial capital costs

(b) Average capital investment

Average annual profit is used in both calculations:

(Total annual cash flows – total depreciation)/project life

($14,500 × 4 – ($50,000 – $10,000)/4 = $4,500 per annum

(a) Initial capital ROCE = $4,500/$50,000 × 100 = 9%

For average ROCE, need average capital investment:

($50,000 + $10,000)/2 = $30,000

(b) Average ROCE = $4,500/$30,000 × 100 = 15%

NB. What if the target return were 12%? Would the project be accepted?

You would need to know whether the target related to the initial or average

method.

15