Page 246 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 246

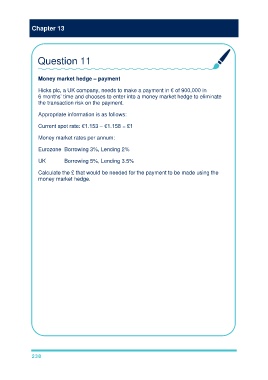

Chapter 13

Question 11

Money market hedge – payment

Hicks plc, a UK company, needs to make a payment in € of 900,000 in

6 months’ time and chooses to enter into a money market hedge to eliminate

the transaction risk on the payment.

Appropriate information is as follows:

Current spot rate: €1.153 – €1.158 = £1

Money market rates per annum:

Eurozone Borrowing 3%, Lending 2%

UK Borrowing 5%, Lending 3.5%

Calculate the £ that would be needed for the payment to be made using the

money market hedge.

Need a € deposit to mature with a value of €900,000 just in time to make the

payment – deposit in € and borrow in £

Present value of € to deposit:

€ 6 month lending rate = 2% × 6/12 = 1%

PV = €900,000/1.01 = €891,089

Buy this amount of € immediately with £:

Buying € with £, bank sells € at low rate = €1.153 = £1

£ spent = 891,089/1.153 = £772,844

Value of £ borrowing at payment date:

£ 6 month borrowing rate = 5% × 6/12 = 2.5%

Final value of £ to be paid off in 6 months = £772,844 × 1.025 = £792,165

238