Page 247 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 247

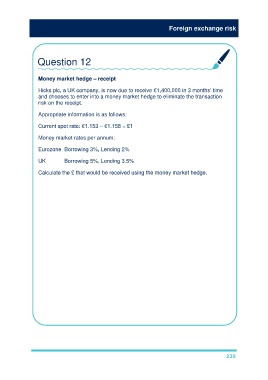

Foreign exchange risk

Question 12

Money market hedge – receipt

Hicks plc, a UK company, is now due to receive €1,400,000 in 3 months’ time

and chooses to enter into a money market hedge to eliminate the transaction

risk on the receipt.

Appropriate information is as follows:

Current spot rate: €1.153 – €1.158 = £1

Money market rates per annum:

Eurozone Borrowing 3%, Lending 2%

UK Borrowing 5%, Lending 3.5%

Calculate the £ that would be received using the money market hedge.

€ receipt will be used to pay off a € borrowing – borrow in € and deposit in £

Present value of € to borrow:

€ 3 month borrowing rate = 3% × 3/12 = 0.75%

PV = €1,400,000/1.0075 = €1,389,578

Use the borrowed € to buy £ immediately:

Selling € to buy £, bank buys € at high rate = €1.158 = £1

£ purchased and deposited = 1,389,578/1.158 = £1,199,981

Value of £ deposit at payment date:

£ 3 month lending rate = 3.5% × 3/12 = 0.875%

Final value of £ = £1,199,981 × 1.00875 = £1,210,481

239