Page 414 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 414

Chapter 20

Market efficiency and the efficient

market hypothesis

7.1 The concept of market efficiency

An efficient market is one in which security prices fully reflect all

available information (i.e. they are fairly priced).

In an efficient market new information is rapidly and rationally

incorporated into share prices in an unbiased way.

Fairly priced shares ensure investor confidence and reflect director

performance.

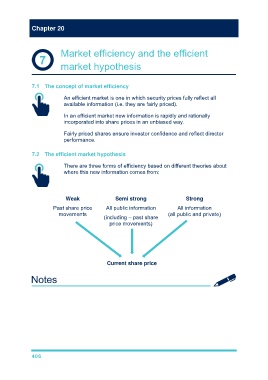

7.2 The efficient market hypothesis

There are three forms of efficiency based on different theories about

where this new information comes from:

Weak Semi strong Strong

Past share price All public information All information

movements (all public and private)

(including – past share

price movements)

Current share price

406