Page 423 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 423

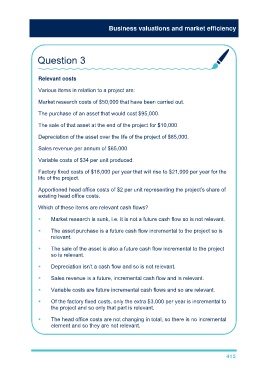

Business valuations and market efficiency

Question 3

Relevant costs

Various items in relation to a project are:

Market research costs of $50,000 that have been carried out.

The purchase of an asset that would cost $95,000.

The sale of that asset at the end of the project for $10,000

Depreciation of the asset over the life of the project of $85,000.

Sales revenue per annum of $65,000

Variable costs of $34 per unit produced.

Factory fixed costs of $18,000 per year that will rise to $21,000 per year for the

life of the project.

Apportioned head office costs of $2 per unit representing the project’s share of

existing head office costs.

Which of these items are relevant cash flows?

Market research is sunk, i.e. it is not a future cash flow so is not relevant.

The asset purchase is a future cash flow incremental to the project so is

relevant.

The sale of the asset is also a future cash flow incremental to the project

so is relevant.

Depreciation isn’t a cash flow and so is not relevant.

Sales revenue is a future, incremental cash flow and is relevant.

Variable costs are future incremental cash flows and so are relevant.

Of the factory fixed costs, only the extra $3,000 per year is incremental to

the project and so only that part is relevant.

The head office costs are not changing in total, so there is no incremental

element and so they are not relevant.

415