Page 425 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 425

Business valuations and market efficiency

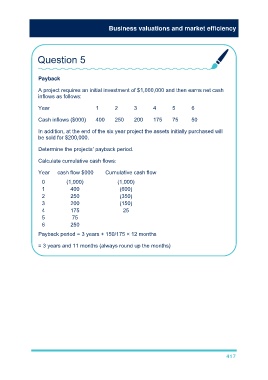

Question 5

Payback

A project requires an initial investment of $1,000,000 and then earns net cash

inflows as follows:

Year 1 2 3 4 5 6

Cash inflows ($000) 400 250 200 175 75 50

In addition, at the end of the six year project the assets initially purchased will

be sold for $200,000.

Determine the projects’ payback period.

Calculate cumulative cash flows:

Year cash flow $000 Cumulative cash flow

0 (1,000) (1,000)

1 400 (600)

2 250 (350)

3 200 (150)

4 175 25

5 75

6 250

Payback period = 3 years + 150/175 × 12 months

= 3 years and 11 months (always round up the months)

417