Page 455 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 455

Business valuations and market efficiency

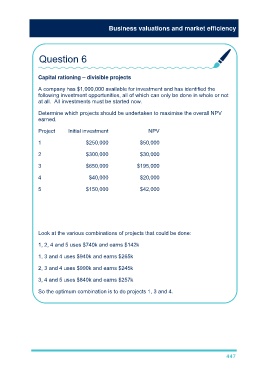

Question 6

Capital rationing – divisible projects

A company has $1,000,000 available for investment and has identified the

following investment opportunities, all of which can only be done in whole or not

at all. All investments must be started now.

Determine which projects should be undertaken to maximise the overall NPV

earned.

Project Initial investment NPV

1 $250,000 $50,000

2 $300,000 $30,000

3 $650,000 $195,000

4 $40,000 $20,000

5 $150,000 $42,000

Look at the various combinations of projects that could be done:

1, 2, 4 and 5 uses $740k and earns $142k

1, 3 and 4 uses $940k and earns $265k

2, 3 and 4 uses $990k and earns $245k

3, 4 and 5 uses $840k and earns $257k

So the optimum combination is to do projects 1, 3 and 4.

447