Page 458 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 458

Chapter 20

Chapter 6

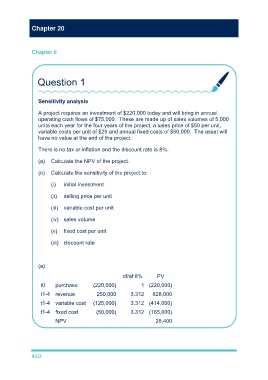

Question 1

Sensitivity analysis

A project requires an investment of $220,000 today and will bring in annual

operating cash flows of $75,000. These are made up of sales volumes of 5,000

units each year for the four years of the project, a sales price of $50 per unit,

variable costs per unit of $25 and annual fixed costs of $50,000. The asset will

have no value at the end of the project.

There is no tax or inflation and the discount rate is 8%.

(a) Calculate the NPV of the project.

(b) Calculate the sensitivity of the project to:

(i) initial investment

(ii) selling price per unit

(iii) variable cost per unit

(iv) sales volume

(v) fixed cost per unit

(vi) discount rate

(a)

df/af 8% PV

t0 purchase (220,000) 1 (220,000)

t1-4 revenue 250,000 3.312 828,000

t1-4 variable cost (125,000) 3.312 (414,000)

t1-4 fixed cost (50,000) 3.312 (165,600)

NPV 28,400

450