Page 75 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 75

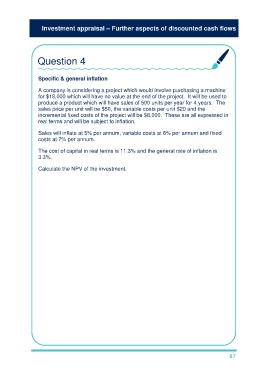

Investment appraisal – Further aspects of discounted cash flows

Question 4

Specific & general inflation

A company is considering a project which would involve purchasing a machine

for $18,000 which will have no value at the end of the project. It will be used to

produce a product which will have sales of 500 units per year for 4 years. The

sales price per unit will be $50, the variable costs per unit $20 and the

incremental fixed costs of the project will be $8,000. These are all expressed in

real terms and will be subject to inflation.

Sales will inflate at 5% per annum, variable costs at 6% per annum and fixed

costs at 7% per annum.

The cost of capital in real terms is 11.3% and the general rate of inflation is

3.3%.

Calculate the NPV of the investment.

Time 0 1 2 3 4

Machine (18,000)

purchase

Sales 26,250 27,563 28,941 30,388

Variable costs (10,600) (11,236) (11,910) (12,625)

Fixed costs (8,560) (9,159) (9,800) (10,486)

Net cash flow (18,000) 7,090 7,168 7,231 7,277

d.f 15% (W1) 1 0.870 0.756 0.658 0.572

Present values (18,000) 6,168 5,419 4,758 4,162

NPV 2,507

Example workings:

Sales year 1 = 500 × $50 × 1.05 = $26,250

Sales year 2 = $26,250 × 1.05 = $27,563, etc.

Money cost of capital = (1.113 × 1.033) – 1 = 0.15 or 15%

67