Page 100 - CFA - Day 1 & 2 Course Notes

P. 100

LOS 7.f: Convert among holding period

yields, money market yields, effective Session Unit 2: Discounted Cash Flow Applications

annual yields, and bond equivalent yields.

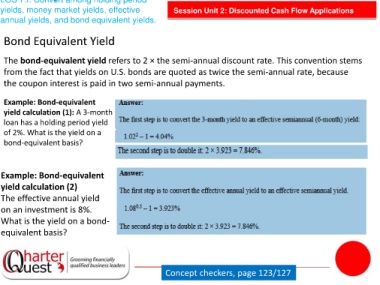

Bond Equivalent Yield

The bond-equivalent yield refers to 2 × the semi-annual discount rate. This convention stems

from the fact that yields on U.S. bonds are quoted as twice the semi-annual rate, because

the coupon interest is paid in two semi-annual payments.

Example: Bond-equivalent

yield calculation (1): A 3-month

loan has a holding period yield

of 2%. What is the yield on a

bond-equivalent basis?

Example: Bond-equivalent

yield calculation (2)

The effective annual yield

on an investment is 8%.

What is the yield on a bond-

equivalent basis?

Concept checkers, page 123/127