Page 98 - CFA - Day 1 & 2 Course Notes

P. 98

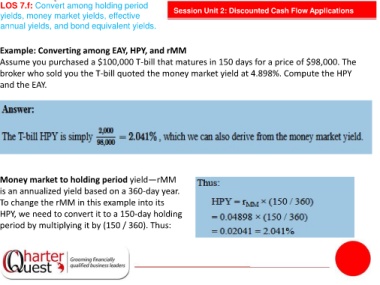

LOS 7.f: Convert among holding period Session Unit 2: Discounted Cash Flow Applications

yields, money market yields, effective

annual yields, and bond equivalent yields.

Example: Converting among EAY, HPY, and rMM

Assume you purchased a $100,000 T-bill that matures in 150 days for a price of $98,000. The

broker who sold you the T-bill quoted the money market yield at 4.898%. Compute the HPY

and the EAY.

Money market to holding period yield—rMM

is an annualized yield based on a 360-day year.

To change the rMM in this example into its

HPY, we need to convert it to a 150-day holding

period by multiplying it by (150 / 360). Thus: