Page 94 - CFA - Day 1 & 2 Course Notes

P. 94

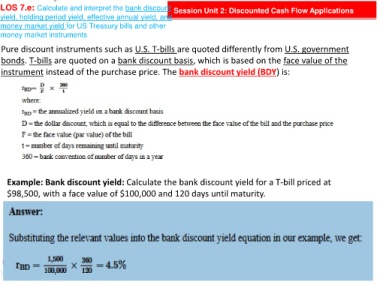

LOS 7.e: Calculate and interpret the bank discount Session Unit 2: Discounted Cash Flow Applications

yield, holding period yield, effective annual yield, and

money market yield for US Treasury bills and other

money market instruments

Pure discount instruments such as U.S. T-bills are quoted differently from U.S. government

bonds. T-bills are quoted on a bank discount basis, which is based on the face value of the

instrument instead of the purchase price. The bank discount yield (BDY) is:

Example: Bank discount yield: Calculate the bank discount yield for a T-bill priced at

$98,500, with a face value of $100,000 and 120 days until maturity.