Page 91 - CFA - Day 1 & 2 Course Notes

P. 91

LOS 7.d: Calculate and compare the

money-weighted and time-weighted rates Session Unit 2: Discounted Cash Flow Applications

of return of a portfolio and evaluate the

performance of portfolios based on these

measures.

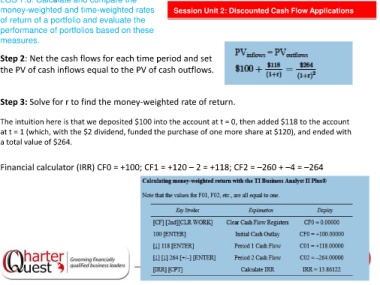

Step 2: Net the cash flows for each time period and set

the PV of cash inflows equal to the PV of cash outflows.

Step 3: Solve for r to find the money-weighted rate of return.

The intuition here is that we deposited $100 into the account at t = 0, then added $118 to the account

at t = 1 (which, with the $2 dividend, funded the purchase of one more share at $120), and ended with

a total value of $264.

Financial calculator (IRR) CF0 = +100; CF1 = +120 – 2 = +118; CF2 = –260 + –4 = –264