Page 88 - CFA - Day 1 & 2 Course Notes

P. 88

LOS 7.a: Calculate and interpret the

net present value (NPV) and the Session Unit 2: Discounted Cash Flow Applications

internal rate of return (IRR) of an investment.

Problems Associated With the IRR Method

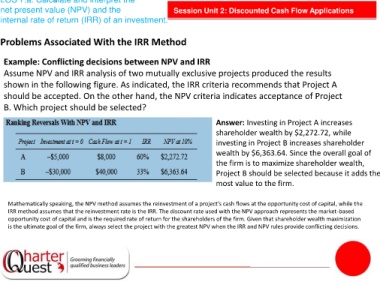

Example: Conflicting decisions between NPV and IRR

Assume NPV and IRR analysis of two mutually exclusive projects produced the results

shown in the following figure. As indicated, the IRR criteria recommends that Project A

should be accepted. On the other hand, the NPV criteria indicates acceptance of Project

B. Which project should be selected?

Answer: Investing in Project A increases

shareholder wealth by $2,272.72, while

investing in Project B increases shareholder

wealth by $6,363.64. Since the overall goal of

the firm is to maximize shareholder wealth,

Project B should be selected because it adds the

most value to the firm.

Mathematically speaking, the NPV method assumes the reinvestment of a project’s cash flows at the opportunity cost of capital, while the

IRR method assumes that the reinvestment rate is the IRR. The discount rate used with the NPV approach represents the market-based

opportunity cost of capital and is the required rate of return for the shareholders of the firm. Given that shareholder wealth maximization

is the ultimate goal of the firm, always select the project with the greatest NPV when the IRR and NPV rules provide conflicting decisions.