Page 84 - CFA - Day 1 & 2 Course Notes

P. 84

LOS 7.a: Calculate and interpret the

net present value (NPV) and the Session Unit 2: Discounted Cash Flow Applications

internal rate of return (IRR) of an investment.

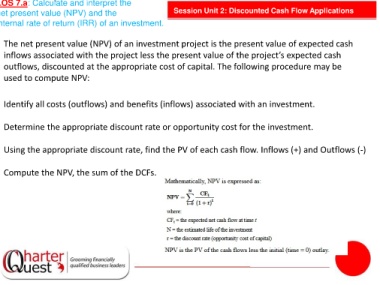

The net present value (NPV) of an investment project is the present value of expected cash

inflows associated with the project less the present value of the project’s expected cash

outflows, discounted at the appropriate cost of capital. The following procedure may be

used to compute NPV:

Identify all costs (outflows) and benefits (inflows) associated with an investment.

Determine the appropriate discount rate or opportunity cost for the investment.

Using the appropriate discount rate, find the PV of each cash flow. Inflows (+) and Outflows (-)

Compute the NPV, the sum of the DCFs.