Page 89 - CFA - Day 1 & 2 Course Notes

P. 89

LOS 7.c: Calculate and interpret a holding

period return (total return). Session Unit 2: Discounted Cash Flow Applications

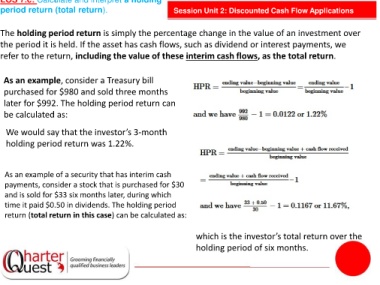

The holding period return is simply the percentage change in the value of an investment over

the period it is held. If the asset has cash flows, such as dividend or interest payments, we

refer to the return, including the value of these interim cash flows, as the total return.

As an example, consider a Treasury bill

purchased for $980 and sold three months

later for $992. The holding period return can

be calculated as:

We would say that the investor’s 3-month

holding period return was 1.22%.

As an example of a security that has interim cash

payments, consider a stock that is purchased for $30

and is sold for $33 six months later, during which

time it paid $0.50 in dividends. The holding period

return (total return in this case) can be calculated as:

which is the investor’s total return over the

holding period of six months.