Page 81 - CFA - Day 1 & 2 Course Notes

P. 81

LOS 6.f: Demonstrate the use of a Session Unit 2: The Time Value of Money

time line in modelling and solving

time value of money problems.. [2nd] [BGN] [2nd] [SET]. When

Funding a Future Obligation this is done, “BGN” will display

in the upper right corner

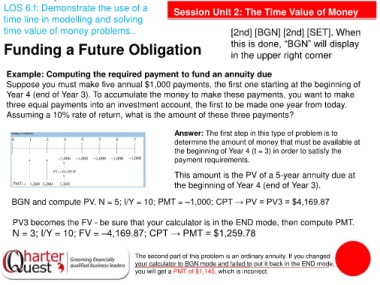

Example: Computing the required payment to fund an annuity due

Suppose you must make five annual $1,000 payments, the first one starting at the beginning of

Year 4 (end of Year 3). To accumulate the money to make these payments, you want to make

three equal payments into an investment account, the first to be made one year from today.

Assuming a 10% rate of return, what is the amount of these three payments?

Answer: The first step in this type of problem is to

determine the amount of money that must be available at

the beginning of Year 4 (t = 3) in order to satisfy the

payment requirements.

This amount is the PV of a 5-year annuity due at

the beginning of Year 4 (end of Year 3).

BGN and compute PV. N = 5; I/Y = 10; PMT = –1,000; CPT → PV = PV3 = $4,169.87

PV3 becomes the FV - be sure that your calculator is in the END mode, then compute PMT.

N = 3; I/Y = 10; FV = –4,169.87; CPT → PMT = $1,259.78

The second part of this problem is an ordinary annuity. If you changed

your calculator to BGN mode and failed to put it back in the END mode,

you will get a PMT of $1,145, which is incorrect.