Page 78 - CFA - Day 1 & 2 Course Notes

P. 78

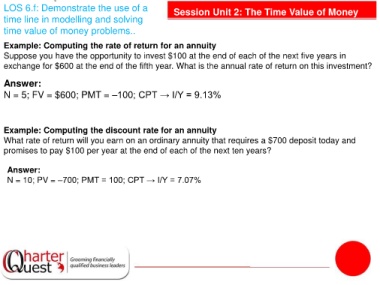

LOS 6.f: Demonstrate the use of a Session Unit 2: The Time Value of Money

time line in modelling and solving

time value of money problems..

Example: Computing the rate of return for an annuity

Suppose you have the opportunity to invest $100 at the end of each of the next five years in

exchange for $600 at the end of the fifth year. What is the annual rate of return on this investment?

Answer:

N = 5; FV = $600; PMT = –100; CPT → I/Y = 9.13%

Example: Computing the discount rate for an annuity

What rate of return will you earn on an ordinary annuity that requires a $700 deposit today and

promises to pay $100 per year at the end of each of the next ten years?

Answer:

N = 10; PV = –700; PMT = 100; CPT → I/Y = 7.07%