Page 76 - CFA - Day 1 & 2 Course Notes

P. 76

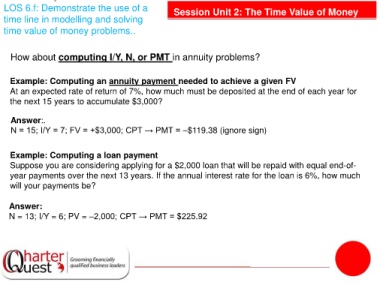

LOS 6.f: Demonstrate the use of a Session Unit 2: The Time Value of Money

time line in modelling and solving

time value of money problems..

How about computing I/Y, N, or PMT in annuity problems?

Example: Computing an annuity payment needed to achieve a given FV

At an expected rate of return of 7%, how much must be deposited at the end of each year for

the next 15 years to accumulate $3,000?

Answer:.

N = 15; I/Y = 7; FV = +$3,000; CPT → PMT = –$119.38 (ignore sign)

Example: Computing a loan payment

Suppose you are considering applying for a $2,000 loan that will be repaid with equal end-of-

year payments over the next 13 years. If the annual interest rate for the loan is 6%, how much

will your payments be?

Answer:

N = 13; I/Y = 6; PV = –2,000; CPT → PMT = $225.92