Page 72 - CFA - Day 1 & 2 Course Notes

P. 72

LOS 6.f: Demonstrate the use of a Session Unit 2: The Time Value of Money

time line in modelling and solving

time value of money problems.

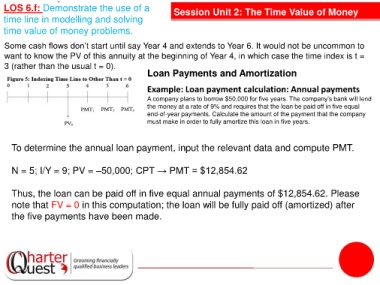

Some cash flows don’t start until say Year 4 and extends to Year 6. It would not be uncommon to

want to know the PV of this annuity at the beginning of Year 4, in which case the time index is t =

3 (rather than the usual t = 0).

Loan Payments and Amortization

Example: Loan payment calculation: Annual payments

A company plans to borrow $50,000 for five years. The company’s bank will lend

the money at a rate of 9% and requires that the loan be paid off in five equal

end-of-year payments. Calculate the amount of the payment that the company

must make in order to fully amortize this loan in five years.

To determine the annual loan payment, input the relevant data and compute PMT.

N = 5; I/Y = 9; PV = –50,000; CPT → PMT = $12,854.62

Thus, the loan can be paid off in five equal annual payments of $12,854.62. Please

note that FV = 0 in this computation; the loan will be fully paid off (amortized) after

the five payments have been made.