Page 69 - CFA - Day 1 & 2 Course Notes

P. 69

LOS 6.e: Calculate and interpret the Session Unit 2: The Time Value of Money

future value (FV) and present value (PV)

of a single sum of money, an ordinary Solving Time Value of Money

annuity, an annuity due, a perpetuity (PV Problems When Compounding

only), and a series of unequal cash flows. Periods Are Other Than Annual

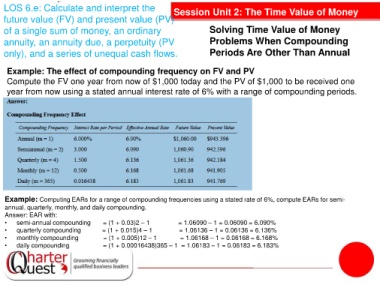

Example: The effect of compounding frequency on FV and PV

Compute the FV one year from now of $1,000 today and the PV of $1,000 to be received one

year from now using a stated annual interest rate of 6% with a range of compounding periods.

Example: Computing EARs for a range of compounding frequencies using a stated rate of 6%, compute EARs for semi-

annual, quarterly, monthly, and daily compounding.

Answer: EAR with:

• semi-annual compounding = (1 + 0.03)2 – 1 = 1.06090 – 1 = 0.06090 = 6.090%

• quarterly compounding = (1 + 0.015)4 – 1 = 1.06136 – 1 = 0.06136 = 6.136%

• monthly compounding = (1 + 0.005)12 – 1 = 1.06168 – 1 = 0.06168 = 6.168%

• daily compounding = (1 + 0.00016438)365 – 1 = 1.06183 – 1 = 0.06183 = 6.183%