Page 66 - CFA - Day 1 & 2 Course Notes

P. 66

LOS 6.e: Calculate and interpret the Session Unit 2: The Time Value of Money

future value (FV) and present value (PV)

of a single sum of money, an ordinary

annuity, an annuity due, a perpetuity (PV

only), and a series of unequal cash flows.

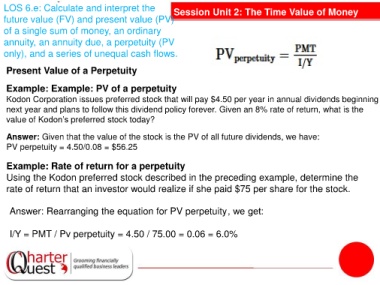

Present Value of a Perpetuity

Example: Example: PV of a perpetuity

Kodon Corporation issues preferred stock that will pay $4.50 per year in annual dividends beginning

next year and plans to follow this dividend policy forever. Given an 8% rate of return, what is the

value of Kodon’s preferred stock today?

Answer: Given that the value of the stock is the PV of all future dividends, we have:

PV perpetuity = 4.50/0.08 = $56.25

Example: Rate of return for a perpetuity

Using the Kodon preferred stock described in the preceding example, determine the

rate of return that an investor would realize if she paid $75 per share for the stock.

Answer: Rearranging the equation for PV perpetuity , we get:

I/Y = PMT / Pv perpetuity = 4.50 / 75.00 = 0.06 = 6.0%