Page 61 - CFA - Day 1 & 2 Course Notes

P. 61

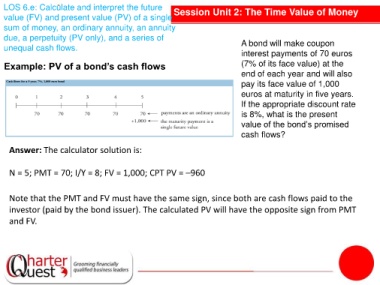

LOS 6.e: Calculate and interpret the future Session Unit 2: The Time Value of Money

value (FV) and present value (PV) of a single

sum of money, an ordinary annuity, an annuity

due, a perpetuity (PV only), and a series of

unequal cash flows. A bond will make coupon

interest payments of 70 euros

Example: PV of a bond’s cash flows (7% of its face value) at the

end of each year and will also

pay its face value of 1,000

euros at maturity in five years.

If the appropriate discount rate

is 8%, what is the present

value of the bond’s promised

cash flows?

Answer: The calculator solution is:

N = 5; PMT = 70; I/Y = 8; FV = 1,000; CPT PV = –960

Note that the PMT and FV must have the same sign, since both are cash flows paid to the

investor (paid by the bond issuer). The calculated PV will have the opposite sign from PMT

and FV.