Page 62 - CFA - Day 1 & 2 Course Notes

P. 62

LOS 6.e: Calculate and interpret the Session Unit 2: The Time Value of Money

future value (FV) and present value (PV)

of a single sum of money, an ordinary

annuity, an annuity due, a perpetuity (PV

only), and a series of unequal cash flows.

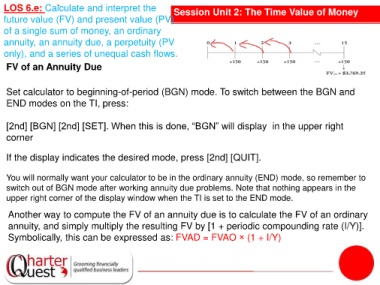

FV of an Annuity Due

Set calculator to beginning-of-period (BGN) mode. To switch between the BGN and

END modes on the TI, press:

[2nd] [BGN] [2nd] [SET]. When this is done, “BGN” will display in the upper right

corner

If the display indicates the desired mode, press [2nd] [QUIT].

You will normally want your calculator to be in the ordinary annuity (END) mode, so remember to

switch out of BGN mode after working annuity due problems. Note that nothing appears in the

upper right corner of the display window when the TI is set to the END mode.

Another way to compute the FV of an annuity due is to calculate the FV of an ordinary

annuity, and simply multiply the resulting FV by [1 + periodic compounding rate (I/Y)].

Symbolically, this can be expressed as: FVAD = FVAO × (1 + I/Y)