Page 63 - CFA - Day 1 & 2 Course Notes

P. 63

LOS 6.e: Calculate and interpret the Session Unit 2: The Time Value of Money

future value (FV) and present value (PV)

of a single sum of money, an ordinary

annuity, an annuity due, a perpetuity (PV

only), and a series of unequal cash flows.

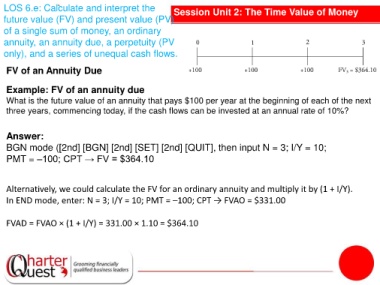

FV of an Annuity Due

Example: FV of an annuity due

What is the future value of an annuity that pays $100 per year at the beginning of each of the next

three years, commencing today, if the cash flows can be invested at an annual rate of 10%?

Answer:

BGN mode ([2nd] [BGN] [2nd] [SET] [2nd] [QUIT], then input N = 3; I/Y = 10;

PMT = –100; CPT → FV = $364.10

Alternatively, we could calculate the FV for an ordinary annuity and multiply it by (1 + I/Y).

In END mode, enter: N = 3; I/Y = 10; PMT = –100; CPT → FVAO = $331.00

FVAD = FVAO × (1 + I/Y) = 331.00 × 1.10 = $364.10